The History & Timeline of Capital Square

Louis Rogers’ role in the founding of ADISA was in the spotlight as the six individuals that came together and shaped the Tenant-In-Common Association (TICA), now known as the Alternative & Direct Investment Securities Association (ADISA), sat down for a 20th anniversary conversation.

The evolution of the real estate investment industry can be profoundly captured in the twenty-year time period between 2003 and 2023, the first twenty years of ADISA; it can also be more greatly understood when analyzing the historical progression and institutionalization of tax-advantaged real estate. However, the history of Capital Square itself is the story of how evolving tax-advantaged real estate investment opportunities can indeed build the future for investors, team members and communities.

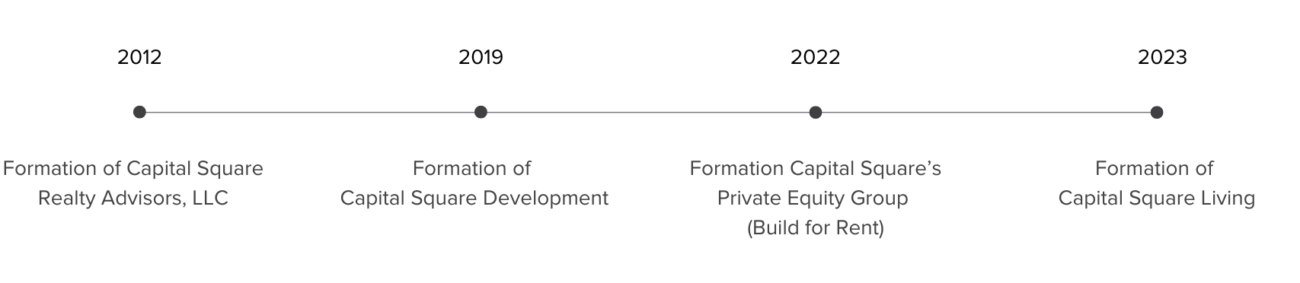

The Timeline of Capital Square

In 2012, when our founder and co-CEO, Louis Rogers, partnered with colleagues he respected from prior firms, together, they seized their combined expertise across multiple fields to develop a new “investors-first” business model with a vision to become the best real estate company in the region – and eventually, the nation. Shaped by steadfast integrity and entrepreneurial gumption, Capital Square began as a Section 1031/DST sponsor but has since grown to be a diversified real estate manager, operator and developer.

Invest. Build. Manage.

In 2014, Capital Square’s acquisitions topped $100 million in a single year for the first time. By 2016, the firm reached $400 million of total properties acquired since inception based on investment cost, and by 2018, acquisitions topped $275 million in a single year, more than the previous two years combined.

Serving our investors as powerfully as possible remained top-of-mind for the growing leadership team, and after the passage of the Tax Cuts and Job Acts of 2017 to stimulate long-term private investments in low-income urban and rural communities nationwide, Capital Square formed a new development team to seize upon the opportunity to provide tax benefits to investors, while promoting economic growth in distressed areas. Investors benefited from tax-deferral and exclusion through new opportunity zone funds, and by entering the development and construction industries, Capital Square knew the growing firm could deliver best-in-class projects synonymous with value.

By 2020, Capital Square’s acquisitions topped $750 million in a single year with assets under management (AUM) surpassing $2.4 billion. AUM increased 175% to 4.3 billion in 2021, and in 2022, not only did Capital Square’s development team deliver their first stabilized OZ deal, AUM surpassed $6 billion.

Capital Square’s private equity group formed in 2022 as well, with an initial investment strategy focus on build-for-rent communities, complementing the firm’s existing multifamily acquisitions and qualified opportunity zone development projects.

In 2023, in addition to surpassing $3 billion in fundraising since 2012, Capital Square again leaned into the firm’s core value of “dynamic growth,” being solidly perched on past successes while fostering a climate of innovation, expansion and continuous improvement. With the launch of Capital Square Living, the firm’s new property management division, Capital Square became a vertically integrated real estate company, harnessing resources to build legacies for investors, team members and communities more powerfully than ever.

Capital Square Living gives the firm’s investors a competitive advantage, offering a level of quality control and across-the-board excellence beyond what is typically offered by a third-party manager. Plus, in-house property management maximizes revenue, increases operating efficiency and reduces costs, while delivering best-in-class service.

Invest. Build. Manage. These three pillars define everything Capital Square does and all of the potential benefits we deliver with the highest standards to our investor community.

Building the Future of Real Estate

Today, Capital Square has four offices across the country (in Richmond, Virginia; Washington, D.C.; Newport Beach, California; and Old Greenwich, Connecticut), is one of the leading sponsors of tax-advantaged real estate investments and has transacted nearly $8 billion in real estate.

Tax advantaged real estate investment has transformed over the years. ADISA has evolved. Legislation has changed what’s possible. Capital Square has stretched and grown too.

This is how we continue building something bigger than ourselves — building the future of investment, of development, of property management and of real estate itself.